Stanko is looking into potential buying or shorting candidates among the most valuable German brands. Many industries have been in secular decline the last few months and it's always important to watch support and resistance levels to find opportunities.

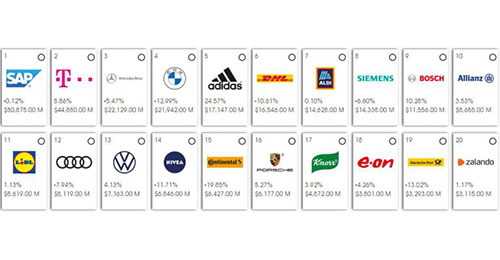

Germany is host to a wealth of globally recognized high-profile brands ranging from automotive companies to telecommunications and IT technologies. With a brand value of almost $51 billion, SAP is Germany’s most valuable company. Deutsche Telekom, Mercedes Benz (Daimler), BMW and Adidas are also making the top five. It is important to mention that SAP and Deutsche Telekom are accounting 30% of the value of the leading 50 brands combined. The automotive industry plays a key role in Germany’s brand elite, BMW, Mercedes-Benz, Porsche, Audi and Volkswagen are all in the top 20 brands. Germany itself has become synonymous with the design and engineering of the many automotive brands it has produced. It is important to mention that despite the economic, social and personal impact of COVID-19, some of these companies saw their total brand value increase. Despite this, there are still overvalued stocks despite the sharp contraction in the market. Two-thirds of fund managers say that the stock market could make a correction and there are still lots of opportunities for shorting.

Given the strength of Germany’s reputation as a leader in the sector in finance, the relatively small influence of financial services brands is apparent – there is only Allianz in the top 20 valuable brands. According to the survey, the most valuable brands have shown more resilience and less volatility in the current COVID-19 crisis than in the global economic crisis 2008-2009. Some of the brands with the biggest declines in value include Continental, BMW, Nivea, Audi and DHL.

Minimum deposit: €100

Description: Ready to trade German shares? Try going long or short with Skilling now!

Risk warning: 82% of non professional CFD accounts lose money.

SAP

SAP is a leader in enterprise applications and this company maintained its position as Germany's most valuable brand. The company was founded in 1972 and is headquartered in Walldorf, Germany. The fundamentals of the company are not bad but with 164 billion EUR market capitalization this company/stock is expensive in my opinion. Despite this, SAP stock is down more than 20% since January 2020. While some might think this could look like a great short selling candidate, others think the recent decline can be an buying opportunity instead.

On this chart (the period from August 2019), I marked major support levels that can help traders to understand where the price could move. The current support level is 100 EUR and if the price breaks this level for several days, it would be a “SELL” signal. Stanko means that if the price breaks 100 EUR for 2-3 days, which represents very strong support, the next target could be located around 80 EUR. Note: The ticker below show SAP in USD prices,

Allianz

Allianz engages in the provision of insurance and investment advisory services. It operates through the following segments: Property-Casualty, Life/Health, Asset Management, Corporate and Other. It is important to mention that Allianz's shares fell through support on fears of the coronavirus Covid-19 pandemic environment despite the fact that Allianz has a very generous yield and solid growth prospects.

On this Allianz chart, I marked major support levels that can help traders to understand where the price could move from around 198 today. The current support level is 170 EUR and if the price breaks this level it would be a “SELL” signal and we have the open way to 150 EUR. If the price breaks 140 EUR which represents very strong support, the next target could be located around 120 EUR.

BMW

The automotive industry plays a key role in Germany’s brand elite: BMW, Mercedes-Benz, Porsche, Audi and Volkswagen are all in the top 20 brands. Bayerische Motoren Werke AG (BMW) engages in the manufacture and sale of automobiles and motorcycles. Coronavirus pandemic continues to have a negative influence on car sales and it is important to mention that sales of BMW fell by 39% in Q2 with both cars and SUVs posting nearly identical decreases. Despite this, BMW stock is up more than 90% since March 2020 and this stock that can be an opportunity for shorting according to quite a few analysts. It depends a lot how quick a vaccine for Covid-19 comes out, and how the global growth figures for Q4 2020 turns out.

On this chart (the period from August 2019), I marked major support levels that can help traders to understand where the price could move. The current support level is 55 EUR and if the price breaks this level it would be a “SELL” signal and we have the open way to 50 EUR. If the price breaks 45 EUR which represents very strong support, the next target could be located around 35 EUR.

Minimum deposit: €250 by bank

Description: Trade BMW and other German share. Try Capital now!

Risk warning: 67.7% of retail investor accounts lose money when trading CFDs with Capital.