- Home

- Brokers

- Short interest

- Stocks

- All stocks

- Positions

- Bank & Financial stocks

- Arow Financial shares

- BBVA shares

- Banco Santander shares

- Bank of America shares

- Bank of Montreal shares

- Bank of Nova Scotia shares

- Capital One shares

- Credit Suisse

- Deutsche Bank shares

- CityGroup shares

- Goldman Sachs shares

- HSBC shares

- JP Morgan shares

- Lloyds Banking shares

- Mizuho shares

- Paypal shares

- Royal Bank of Scotland shares

- Wells Fargo shares

- Shorting cannabis

- AbbVie shares

- Alternative Harvest ETF

- Amphenol shares

- Amyris shares

- Aphiria shares

- Aurora Cannabis shares

- Canopy Growth shares

- CARA Therapeutics shares

- Happiness Biotech shares

- IIPR shares

- Mannatech shares

- Natural Alternatives shares

- Scotts Miracle-Gro shares

- Sundial Growers shares

- The Cannabis ETF

- Tilray shares

- Cars & Vehicles stocks

- Casino & gambling stocks

- Boyd Gaming shares

- Caesars Ent. shares

- Century Casinos shares

- Churchill Downs shares

- Eldorado Resorts shares

- Everi Holdings shares

- Galaxy Gaming shares

- IGT shares

- Las Vegas Sands shares

- Melco Resorts shares

- MGM Resorts Int shares

- Penn National Gam. shares

- Scientific Games shares

- Studio City shares

- The Stars Group shares

- William Hill shares

- Wynn shares

- Communication stocks

- Consumer Service Industry

- Flights & travel stocks

- Gun & Defense stocks

- Aerospace & Defence ETF

- AeroVironment shares

- Baxter Int. shares

- Direxion A&D Bull 3x ETF

- General Dynamics shares

- Heico Corp shares

- Honeywell Int. shares

- Howmet Aerospace shares

- Huntington Ingalls shares

- L3Harris Tech shares

- Lockheed Martin shares

- Northrop Grumman shares

- Oshkosh Corp shares

- Raytheon Co shares

- Saab AB shares

- Textron, Inc shares

- The Boeing Co shares

- TransDigm Group shares

- United Technologies shares

- Vista Outdoor shares

- Healthcare sector

- IT stocks

- Logistics stocks

- Oil & Gas sector

- Real Estate sector

- Apartment Invest. shares

- Boston Properties shares

- CBRE Group shares

- Crown Castle Int. shares

- Duke Realty shares

- Equity Residential shares

- Healthpeak Properties shares

- Host Hotels shares

- iShares CMBS ETF

- Kimco Realty shares

- Realty Income shares

- Redfin Corp shares

- Simon Property shares

- Ventas shares

- Vornado Realty shares

- Welltower shares

- Weyerhaeuser Comp shares

- Retail stocks

- Sin Stocks

- Socially Responsible Investments

- Tech stocks

- Utilities stocks

- Learn

- News

AvaTrade Broker Review

AvaTrade is a really professional broker focused on short selling of shares, crypto currencies, commodities and currency pairs, all with outstanding support and competitive CFD spread. Through extensive regulation in six different jurisdictions, AvaTrade follows the toughest financial rules and almost everyone can engage in shorting here. Their range of commodities, currencies, ETFs, indices and cryptocurrencies available to go short on is also outstanding. To help beginners get started with online trading, there is their own training on SharpTrader. Here is everything a trader needs for daily trading, such as videos with facts and tips, daily technical analyzes of AvaTrade's own analysts, and plenty of tips to become an improved trader. Read our brief overview below and then create your own opinion before starting with short selling. One of the best brokers for going short in equity, commodity and cryptocurrencies is AvaTrade, sign up now!

-

Min. deposit

€50

-

Platforms

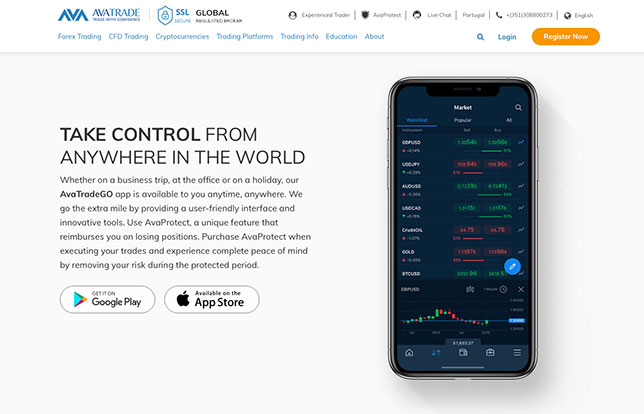

AvaTradeGO app

-

Founded

2006

-

Regulators

6

-

Country

Ireland

-

Commodities/Crypto

Yes

-

Stock trading

Yes

-

Multi language

Yes

-

Support

Email, Phone

-

Account currencies

EUR GBP USD

Background

Deposits to your AvaTrade currency account can be made with either EUR, GBP, USD or a wide range of other base currencies.

Withdrawals go much faster through AvaTrade than many competing foreign exchange companies. Wait a maximum of 48 hours before the money is in your bank account, or even faster if you choose Paypal, for example.

Leverage

Costs

Benefits

+ Among the best personal service in the market and uncompromising integrity when short selling stocks or cryptocurrencies.

+ Regulated from 6 different markets, which means that they follow all the rules for any jurisdiction extremely well.

+ Quick and easy deposits and withdrawals with PayPal, debit card and bank transfer to name a few.

+ Honest and long-term short-selling broker.

Drawback

-Do not have MetaTrader 5 integration.

-The minimum investment is € 100 to get started with short-selling.

Platforms

AvaTrade's user-oriented perspectives, combined with strong financial backing, are unique in online commerce. From its 24-hour multilingual support to its wide range of platforms and services, AvaTrade has created the optimal trading environment for every level of retailer. Avatrade's broad business area encompasses a full range of trading instruments, including currencies, equities, commodities and indices.

Ava is a multinational company with regional offices and sales centers in Paris, Dublin, Milan, Tokyo and Sydney. The company's head office is in Dublin, Ireland.

Whether you are an experienced trader or a beginner, AvaTrade's customizable trading platforms and services provide you with the right balance of simplicity and elegance. It's no wonder Ava has received nine industry awards since 2009. If you are serious about short-selling, then look no further. Try shorting some major shares through AvaTrade today!