- Home

- Brokers

- Short interest

- Stocks

- All stocks

- Positions

- Bank & Financial stocks

- Arow Financial shares

- BBVA shares

- Banco Santander shares

- Bank of America shares

- Bank of Montreal shares

- Bank of Nova Scotia shares

- Capital One shares

- Credit Suisse

- Deutsche Bank shares

- CityGroup shares

- Goldman Sachs shares

- HSBC shares

- JP Morgan shares

- Lloyds Banking shares

- Mizuho shares

- Paypal shares

- Royal Bank of Scotland shares

- Wells Fargo shares

- Shorting cannabis

- AbbVie shares

- Alternative Harvest ETF

- Amphenol shares

- Amyris shares

- Aphiria shares

- Aurora Cannabis shares

- Canopy Growth shares

- CARA Therapeutics shares

- Happiness Biotech shares

- IIPR shares

- Mannatech shares

- Natural Alternatives shares

- Scotts Miracle-Gro shares

- Sundial Growers shares

- The Cannabis ETF

- Tilray shares

- Cars & Vehicles stocks

- Casino & gambling stocks

- Boyd Gaming shares

- Caesars Ent. shares

- Century Casinos shares

- Churchill Downs shares

- Eldorado Resorts shares

- Everi Holdings shares

- Galaxy Gaming shares

- IGT shares

- Las Vegas Sands shares

- Melco Resorts shares

- MGM Resorts Int shares

- Penn National Gam. shares

- Scientific Games shares

- Studio City shares

- The Stars Group shares

- William Hill shares

- Wynn shares

- Communication stocks

- Consumer Service Industry

- Flights & travel stocks

- Gun & Defense stocks

- Aerospace & Defence ETF

- AeroVironment shares

- Baxter Int. shares

- Direxion A&D Bull 3x ETF

- General Dynamics shares

- Heico Corp shares

- Honeywell Int. shares

- Howmet Aerospace shares

- Huntington Ingalls shares

- L3Harris Tech shares

- Lockheed Martin shares

- Northrop Grumman shares

- Oshkosh Corp shares

- Raytheon Co shares

- Saab AB shares

- Textron, Inc shares

- The Boeing Co shares

- TransDigm Group shares

- United Technologies shares

- Vista Outdoor shares

- Healthcare sector

- IT stocks

- Logistics stocks

- Oil & Gas sector

- Real Estate sector

- Apartment Invest. shares

- Boston Properties shares

- CBRE Group shares

- Crown Castle Int. shares

- Duke Realty shares

- Equity Residential shares

- Healthpeak Properties shares

- Host Hotels shares

- iShares CMBS ETF

- Kimco Realty shares

- Realty Income shares

- Redfin Corp shares

- Simon Property shares

- Ventas shares

- Vornado Realty shares

- Welltower shares

- Weyerhaeuser Comp shares

- Retail stocks

- Sin Stocks

- Socially Responsible Investments

- Tech stocks

- Utilities stocks

- Learn

- News

eToro Broker Review

Short selling stocks or buying stocks with eToro approach has a lot of advantages on, but not limited to, price. The platform has no limit on the volume of trades. It also permits the execution of fractional purchase of shares while giving its clients unpaid access to essential TipRanks expert share analysis and probable price targets. You can either short sell stocks or go long with CFDs. You are therefore not limited to short selling alone. In addition to this, you can sign up and get verified in a few simple steps. Start trading with eToro today!

-

Min. deposit

€/$50

-

Platforms

eToro Platform

-

Founded

2007

-

Regulators

3

-

Country

Cyprus & UK

-

Commodities/Crypto

Yes, Yes

-

Stock trading

Yes

-

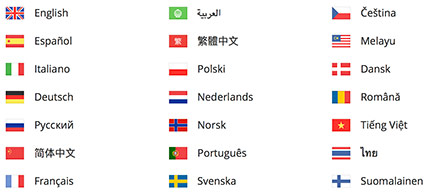

Multi language

Yes

-

Support

E-mail Phone

-

Account currencies

GBP EUR USD SEK

Background

In 2007, the company was nothing more than a vision of three motivated and ambitious entrepreneurs. The three set out on a mission to revolutionize the trading industry. Armed with an idea of making trading available for everyone across the globe and reducing the dependency of people on conventional trading systems, the three had their job cut out for them.

eToro presented itself, for the first time, into the market as an education site that sought to educate traders, using a graphical representation of the different financial instruments.

In 2009, the company launched its online web trader. The innovative, cutting-edge trading platform allowed traders from across the world to access the financial markets. It enabled registered users to trade financial assets of their liking by providing professional trading tools for newbies and advanced traders.

1n 2010, the company launched OpenBook, which was the first global social trading arena. The platform allows any willing investor to invest in the financial markets by copying trades from successful traders through the platform's CopyTrader feature. It would later win a Finovate Europe Best of Show the following year.

The subsequent years saw multiple innovations crop up in eToro until 2018 when the company launched the US cryptocurrency trading platform. However, it should be duly noted that the company seeks to spread the service to other locations.

eToro is a licensed and regulated broker for shorting CFDs. eToro has an excellent general trust score that makes it a safe broker. The company is neither traded publicly nor owns a bank. In the UK, eToro (UK) Ltd is regulated by the Financial Conduct Authority (FCA). In Australia, the company, eToro, is regulated by the Cyprus Securities and Exchange Commission and the Australian Securities & Investment Commission.

The company offers investors a chance to invest in forex and CFDs by providing a wide array of investment options. There are over 2000 assets both in forex, CFDs, and ETFs.

The company stands out for its social trading platform. Apart from its crypto trading and stock trading, the company has a lot of social trading components. Additionally, the company has made it easy for beginners to access financial markets.

Leverage

Clients from Australia and other professional traders are allowed to leverage their investment up to 10x their capital, and 20x on specific stocks. It is, however, essential for you to understand that all stocks traded using leverage is traded as a CFD and not as an asset.

Leverage allows traders to trade with borrowed money. Traders who understand how to trade, use leverage to access larger lot sizes, and place bigger risks. On the flip side, leverage can be detrimental to the financial progress of your account. Taking more leverage than your account might lead to the complete loss of your capital. Only use leverage when you have the right strategy.

Costs

The platform charges weekend fees on all open CFD positions. Transactions that are executed as non-CFDs do not incur weekend charges. Instead, a conversion and withdrawal fee is charged on these transactions. The company charges weekend/overnight fees to all CFD positions, including the freedom to go short and leveraged positions.

The company updates relevant information regarding current spreads, market hours, and overnight fees charged. A fee is attached to all open trades during a market gap. The cost is put on the difference between the opening and closing price of the transaction and is payable at the close of the transaction.

You need to open and verify your account, then make a $200 deposit for you to start trading.

eToro charges an inactivity fee when an account is declared inactive. An inactive account is defined as one which the user has not logged in for a period of twelve months. For such accounts, an $10 inactivity fee is deducted from the available funds in the account. The inactivity fee is only charged in accounts with money. They will not close any active position to cater to the $10 fee. Charging of inactivity fees will come to an end when you activate your account by logging in.

Benefits

+ You are not limited to daily trading volume and there are no fees if you are inactive.

+ The company will enable you to purchase fractional shares.

+ You are not charged to access TipRanks professional stock analysis provided on the platform.

+ The company notifies you on market events and volatility.

+ Excellent social trading plattform that gives inspiration from other traders.

+ Quick and easy to understand!

Drawback

- The withdrawal process is relatively expensive and slow.

- Could have lower spread for some currency pairs.

Platforms

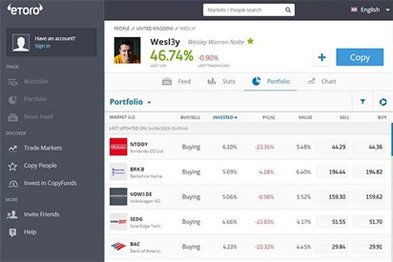

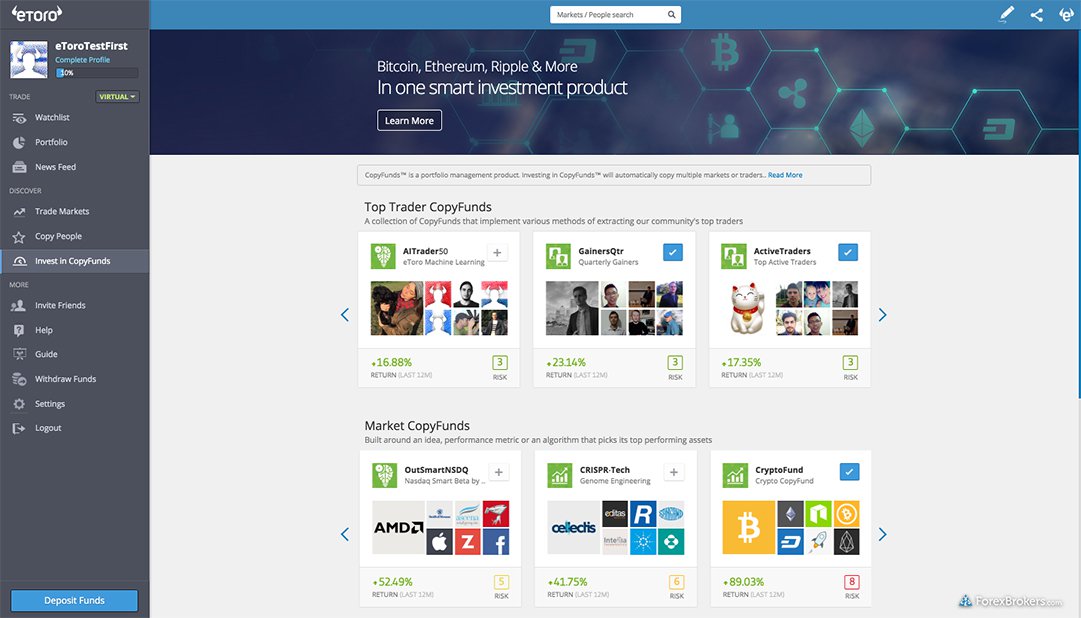

eToro's own trading platform is in-house developed and really fast - both to learn to use and to close a trade. Everything is very intuitive, so you don't have to think about how things work.

All of these platforms offer over 2000 assets, ready-made copy portfolios, and platforms that are easy to use. In addition to this, the media have great functionality and design. The buttons and menus are located in the right place, each having proper labels with a great color scheme. Its inbuilt search function is predictive and extraordinary to use. The process of placing orders is straightforward. It has trailing stop loss, limit, and market orders.

eToro's popular investors constitute a fresh crop of portfolio managers. These are investors who have a unique investment formula for creating winning trades that are copied by their followers. Both the trader and his followers must have signed up on the eToro copy trader.

Popular investors in eToro stand a chance to earn fixed payments. In some cases, they make 2% of the annual asset under their management. The traders also earn income from their own trading activities. In total, one might bag a lump of cash. For you to become a popular trader in eToro, you need to begin by creating and funding your account. Create your profile by describing relevant information about your trading strategy and sharing your name. You can also add your photo.

Once your profile is set up, you need to start trading and networking with other traders and your followers to gain the necessary attention. When you get your first copier and satisfy the minimum entry requirements, you will be ready and accepted as one of eToro's popular investors.

PS. In case you are from the US, then visit the review for eToro US instead.

Support

The company has its focus on responding to all its clients' needs on time. Currently, the company may take up to seven days to respond to your questions. However, if you need to talk to a customer urgently, you need to chat through a live agent.

All clients who seek redress will be attended to in due time. eToro is deliberate about keeping their clients happy by resolving all issues that arise along the way. In addition to this, the company has a help section on their website where traders can get answers to the frequently asked questions. It is, therefore, prudent for you to look at the questions and answers before calling or messaging the company. Your answer might be on the FAQs. Here are some that will enlighten you on some crucial concerns most clients have.

FAQ

As an American, can I trade with eToro?

Yes, but you need to sign up with the US version of eToro here.I live in Europe, can I trade with eToro?

Yes, as long as you signup with eToro based in Europe here.Is eToro good for beginners?

eToro offers social trading, which allows beginners to copy trades of experienced traders and make decent profits in the process.Can I change my username on eToro?

eToro does not allow clients to change their username. Nonetheless, you can request the company to shut the account you are using at the moment and open a new eToro account with a different user name. open a new eToro account.Why do I need to verify my account?

You need to verify your account so that you can access all the financial services provided by the company. It also ensures that both you and the company comply with the relevant financial regulations set by the authorities. In order to verify your account, you will be required to submit a proof of address, your phone number, and your government-issued identification document. It is also essential for you to verify your account as soon as you can to access the company's unlimited services.IWhat are CopyPortfolios?

They are eToro's premium services that provide new traders with an opportunity to copy trades from professional traders. eToro satisfies most of the traditional consumer protection safety standards. It also helps new traders to earn profits through their social trading platform. These two qualities make it a great platform for new and experienced traders.More News about eToro

-

Buy or go short in AMC? Technical support & resistance

The Reddit Forum made AMC on of the most popular shares to buy in Q1, 2021. But how popular will AMC be among traders in Q2?. Today, ShortSelling will talk about the latest important news connecte...

-

Buying or Shorting EUR/SEK? Technical support & resistance

Today, ShortSelling will discuss the opportunities to buy or short sell the EUR/SEK currency pair, that's been moving downwards for a while. ShortSelling also bring up some of the latest upcoming...