- Home

- Brokers

- Short interest

- Stocks

- All stocks

- Positions

- Bank & Financial stocks

- Arow Financial shares

- BBVA shares

- Banco Santander shares

- Bank of America shares

- Bank of Montreal shares

- Bank of Nova Scotia shares

- Capital One shares

- Credit Suisse

- Deutsche Bank shares

- CityGroup shares

- Goldman Sachs shares

- HSBC shares

- JP Morgan shares

- Lloyds Banking shares

- Mizuho shares

- Paypal shares

- Royal Bank of Scotland shares

- Wells Fargo shares

- Shorting cannabis

- AbbVie shares

- Alternative Harvest ETF

- Amphenol shares

- Amyris shares

- Aphiria shares

- Aurora Cannabis shares

- Canopy Growth shares

- CARA Therapeutics shares

- Happiness Biotech shares

- IIPR shares

- Mannatech shares

- Natural Alternatives shares

- Scotts Miracle-Gro shares

- Sundial Growers shares

- The Cannabis ETF

- Tilray shares

- Cars & Vehicles stocks

- Casino & gambling stocks

- Boyd Gaming shares

- Caesars Ent. shares

- Century Casinos shares

- Churchill Downs shares

- Eldorado Resorts shares

- Everi Holdings shares

- Galaxy Gaming shares

- IGT shares

- Las Vegas Sands shares

- Melco Resorts shares

- MGM Resorts Int shares

- Penn National Gam. shares

- Scientific Games shares

- Studio City shares

- The Stars Group shares

- William Hill shares

- Wynn shares

- Communication stocks

- Consumer Service Industry

- Flights & travel stocks

- Gun & Defense stocks

- Aerospace & Defence ETF

- AeroVironment shares

- Baxter Int. shares

- Direxion A&D Bull 3x ETF

- General Dynamics shares

- Heico Corp shares

- Honeywell Int. shares

- Howmet Aerospace shares

- Huntington Ingalls shares

- L3Harris Tech shares

- Lockheed Martin shares

- Northrop Grumman shares

- Oshkosh Corp shares

- Raytheon Co shares

- Saab AB shares

- Textron, Inc shares

- The Boeing Co shares

- TransDigm Group shares

- United Technologies shares

- Vista Outdoor shares

- Healthcare sector

- IT stocks

- Logistics stocks

- Oil & Gas sector

- Real Estate sector

- Apartment Invest. shares

- Boston Properties shares

- CBRE Group shares

- Crown Castle Int. shares

- Duke Realty shares

- Equity Residential shares

- Healthpeak Properties shares

- Host Hotels shares

- iShares CMBS ETF

- Kimco Realty shares

- Realty Income shares

- Redfin Corp shares

- Simon Property shares

- Ventas shares

- Vornado Realty shares

- Welltower shares

- Weyerhaeuser Comp shares

- Retail stocks

- Sin Stocks

- Socially Responsible Investments

- Tech stocks

- Utilities stocks

- Learn

- News

Capital Broker Review

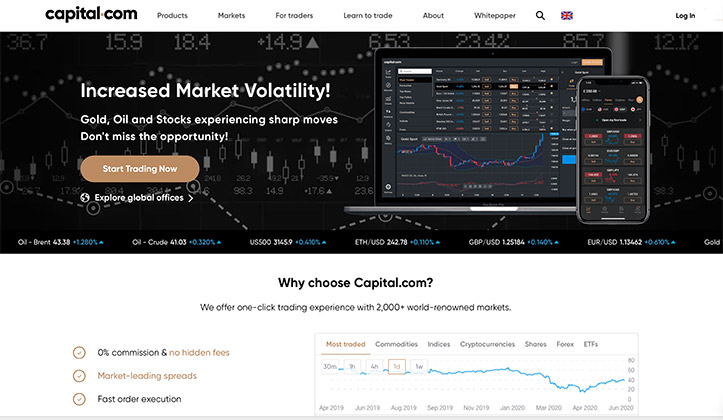

Capital.com is a great fintech firm with access to short selling and buying through CFDs. They have their main offices in Cyprus, Gibraltar and London. The company seeks to create a market for commercial and retail traders by giving them access to various financial markets. Thanks to advanced AI technology, Capital can provide crucial financial advice and ideas to its clients across the globe. In addition to this, the company offers traders the opportunity of short selling stocks at an affordable price. The company boasts of providing traders with access to more than 4282 instruments. Here is more of what you need to know about the platform. Try Capital today - a better broker! Risk warning: 67.7% of retail investor accounts lose money when trading CFDs with Capital.

-

Min. deposit

€250 by bank

-

Platforms

3

-

Founded

Apr 7, 2016

-

Regulators

3

-

Country

Cyprus

-

Commodities/Crypto

Yes, Yes

-

Stock trading

Yes

-

Multi language

Yes

-

Support

Yes

-

Account currencies

GBP EUR USD PLN

Background

Risk warning: 67.7% of retail investor accounts lose money when trading CFDs with Capital.

The company operates from three locations across the world, namely, Belarus, Cyprus and London.

It is currently one of the few CFD platforms that have completely complied with all the regulations set by the European Security and Markets Authority (ESMA). The company helps its clients to protect their money by offering a 30:1 leverage ratio. It is also regulated by reputable bodies like the CySEC and FCA.

The platform different from other brokers because of its unique customer service. Its top of the art web and mobile platform makes it easy for traders to execute shorting positions. There is a minimum to no lag time in trade execution, which makes a big difference on matters profit.

Leverage

With these leverages, traders can go short or long their favourite asset. Additionally, these leverages are set as they are to minimize the risk that a trader takes. This is especially important for newbies. Overleveraging your account without adequate capital is very risky and might cause serious losses to a trader. Capital.com also has negative balance protection in place to protect a trader from the possibility of losing more than their deposit amount.

Risk warning: 67.7% of retail investor accounts lose money when trading CFDs with Capital.

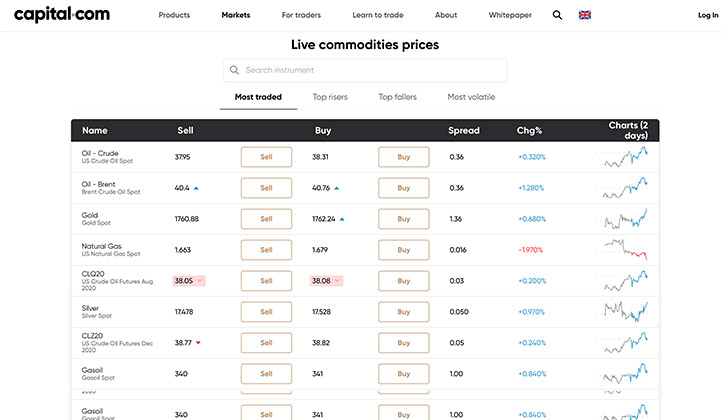

Costs

Given that Capital.com does not charge more fees, its pricing regime is one of the best in the current broker market. It favours client profitability as opposed to company revenue. The low-cost environment offered by Capital.com is most favourable to institutional traders and high-frequency clients.

The company does not charge deposit and withdrawal fees. Instead, it covers these charges. It also converts foreign currencies that are not supported by your preferred payment method so that you can have an easy time depositing and withdrawing your cash.

The company has an additional fee that is charged based on a client's trading habits. These rates are also cheap. Capital.com charges an overnight fee on leveraged products. This fee differs depending on the market instrument that you choose. You can learn more on the fee for your specific instrument on the company's website market information section. Straight up, you can make more by saving on fees with capital.com, compared to other brokers.

Currently, Capital.com does not have an effective promotion or deals running, which serves as an indication of the company's strength in the market. The company does not allow its clients to rely on offers. Such offers provided by various platforms tend to be more of marketing gimmicks than helpful features.

The company has three types of trading accounts, namely, Standard, Plus, and Premier. Even though each of these accounts provides similar core features and service, their benefits differ depending on the individual account used. The minimum deposit goes from as little as 20 USD / 20 EUR when a debit card such as VISA or Mastercard is used, up to 250 EUR / 250 USD for bank deposits.

While most users get a standard account (up to 3000 EUR or USD), the plus account which start from 3000 eur or usd deposit and gives access to custom analytics and a dedicated account manager, along with a dedicated trading platform walkthrough. For deposits above 10 000 EUR or USD, Capital users get access to premier accounts, having unlimited access to private webinars and events.

Professional accounts on this platform have to satisfy minimum requirements and trading experience before being recognized and given access to a lot more margin and complex instruments.

Benefits

+The company provides actionable insights that allow users to learn from their mistakes and improve.

+Simple and effective platform to use.

+Does not charge commissions on trades.

+Low leverage with the option of increasing on request.

+Capital got a great app

Drawback

Platforms

The platform allows traders to carry out manual analysis on markets by providing more than seventy technical indicators as well as a wide array of drawing instruments. Traders can conduct in-depth market analysis by enhancing fundamental reports.

The platform has a multi-chart toggling option that permits running of six tabs at a time. Its personalized watch list makes it easy for the management of multiple portfolios. This platform prioritizes risk management and hedging tools which provide increased security of capital in use as well as the complexity of executing strategies. Because of the ease of use of this platform and its modern look, it is easy for manual traders to use and succeed.

The company also got Capital's CFD trading app for mobile. The The mobile app is adapted for Android and iOS. It is suited for traders who prefer to trade on the go. You can download the trading app directly from Google play store.

Risk warning: 67.7% of retail investor accounts lose money when trading CFDs with Capital.

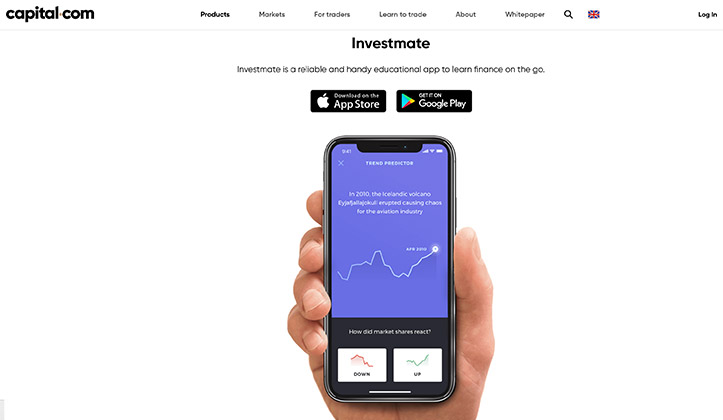

Capital.com has also created another app dubbed Investmate. It is purely for educational purposes and is available on Android and iOS.

Support

The company's customer care is quick to respond to your issues, thus ensuring you spend a lot of your quality time trading the markets.

Screenshots

FAQ

How do I fund my account?

If you want to go short with Capital.com on CFDs, you have to fund your account first. You can make your first deposit into your trading account using Bank Wire Transfer, Debit Card, Credit Card, Sofort, Giropay, iDeal, Przelewy24, Multibanko, Webmoney, QIWI, Trustly, AstropayTEF, 2c2p or Webmoney. However, all the other deposits can be made through Skrill and Neteller.How can I withdraw money from my account?

To ensure the security of its client's money, Capital.com allows you to make withdrawals using the same method that you made your payments. It means that if you used QIWI to deposit your money, which is the same route that your withdrawal request will be fulfilled. In the event that you used multiple cards to fund your account, the company will send money to the card which was used last to deposit money into the trading account.How do I change the currency of my account?

The platform does not support this option. Instead, you can open a new account with a different currency. Complete this request by adding a live account from the account tab, on top of the screen of your desktop.What kind of documents can I provide to prove my identity?

Proof of identity is an essential step in the account registration process. You will be asked to submit your national identification card, your passport, and your driver's license. Each of these documents should be captured from the front and the back. Capital.com is a game-changer. Apart from being one of the cheapest brokers in the market today, the company also has a trading platform that is optimized to benefit the user. It offers excellent customer service to all its clients, thus ensuring everyone signed up with the company fits in well. With about 4282 assets at the moment, Capital.com has made it possible for traders to create riches from the comfort of their homes. Traders do not have to worry about unscrupulous broker activities because the broker is regulated by some of the most reputable financial regulators in the world. Sign up today and try your hand to what could end up being an excellent means of livelihood for you and your family.Risk warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67,7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.More News about Capital

-

Buying or Shorting Solana and Cardano? Technical support & resistance

This post will talk about the latest important news connected with Solana (SOL) and Cardano (ADA) and where the price of these two cryptocurrencies could move in the upcoming period. The cryptocurr...

-

Buy or go short in AMC? Technical support & resistance

The Reddit Forum made AMC on of the most popular shares to buy in Q1, 2021. But how popular will AMC be among traders in Q2?. Today, ShortSelling will talk about the latest important news connecte...