Common questions regarding trading platforms

How do I know if a broker suits me?

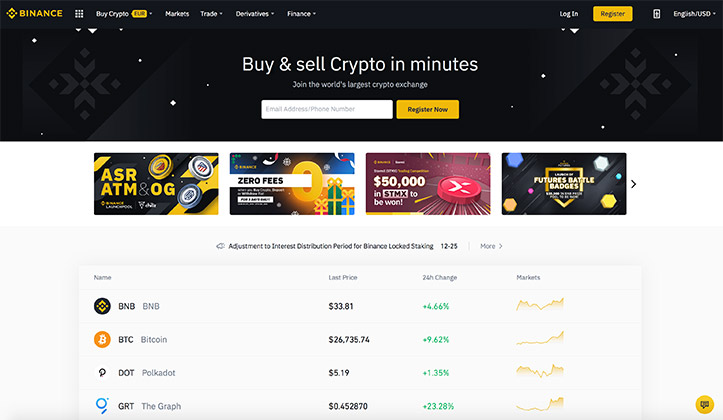

A good way to get a quick understanding if a broker may be suitable is by viewing our screenshots for web and mobile users. Thereafter, read about a couple of short selling broker reviews and go for the one you like the most.

How can a broker allow shorting of shares?

There are two ways they can allow it. The traditional short selling method is by calling up other brokerage firms and find someone willing to lend you their shares for a commission. That usually consist of an upfront fee (10-15% of the total amount) and a daily fee on top of that. The modern way of short selling shares is with CFD's or contract for difference as it's called. A broker will give prices that mimic the actual rates and are based on the underlying shares, but you don't own the physical shares. In an extreme downturn if may be slightly less profit as a “modern short seller”, while you usually limit the losses to what you put in in the worst-case scenario. The most popular shares such as Tesla usually mimic the actual value of the shares even closer than less traded shares.

Do my broker earn commission when I make a profitable trade?

It depends on the broker, there are many different types. Some that earn commission include hybrid-brokers, STN and ECN brokers, while market makers don't earn any commission. However, it's not necessary negative for them to get a small cut of each trade. It may allow the firm to give better pricing.

Will my broker earn money when I made a bad trade?

Some short selling brokers will make more than others, especially market makers. They usually don't have the same range of liquidity providers and are forced to set the prices themselves. Usually, we recommend STN, ECN and Hybrid brokers instead. None of the latter three will earn any money when you do a bad trade. Find a suitable hybrid, STN- or ECN-broker at ShortSelling.com today!

Can you go short in oil?

Yes, there are multiple brokers that offer short positions for brent or crude oil with CFD's. If you are negative to the future oil price, it may be a good idea to go short with help of CFD's that mimic the prices for the underlying asset. ShortSelling.com have a top list of the best brokers for oil trading.

What do you do with dishonest brokers for short selling?

First of all, we don't list them at all here. All brokers without a serious licensing will never be listed. Dishonest and misleading brokerage firms will rather be shown on our warning list, with clear and simple reasons why they are not listed and what they done wrong.

Which is the best broker for short selling?

There are multiple different types of brokers and they usually have their own advantages and disadvantages. In the end, it depends on your location, language preferences, preferred instruments among other things. Read our reviews about the best brokers for short selling to get a better understanding of what may be suitable for your own preferences.

Does Skilling allow shorting of U.S shares?

Yes, Skilling allow European and Asian traders to go either long or short in most American shares through CFDs. You can get started from from €/$/£ 100 with a short selling account at Skilling.

Can you start short selling with 1000?

Often, the minimum amount to get started with a short selling CFD account is about 100-250 EUR, USD or GBP. Therefore, €/£ 1000 is way below the average minimum deposit amount. Still, we recommend that you put in at least €/£ 2500 in order to be able to cover swings in the market better.

Can short selling be risky?

Yes, like all financial investments or speculation, shorting a specific stock or index can be risky. Most short selling brokers don't allow you to lose more than you put in when trading with CFD's, while traditional shorting where you borrow shares can have an unlimited downside. We recommend that you never invest more than you are able to loose and discuss with a financial advisor before getting started.

Does Plus500 encourage short selling?

Plus500 don't mind if you go long or short in any stocks, commodities, indices or crypto currencies with CFD's. However, they do not encourage shorting, but they do allow it. You don't need to own the shares you don't believe in when trading with CFD's.

Our review process of the brokers for short selling listed above are based on the following principles.

Editorial Independence

The people involved in reviews for Short Selling have no active positions in any individual shares, indices, gold or oil CFD's, crypto currencies, indices or currencies.

Editorial independence is crucial for this website to be independent. In order to ensure you get honest reviews of brokerages, various instruments and news posts – all content creators are not actively trading on a daily basis. An objective review process remains a key element for the founders of Short Selling, ensuring you get a complete picture of what's going on.

Protection, Regulations & Safety of the Users

Regulated short selling brokers with CFD's ensure that clients get the protection required. Our preferred licensing bodies include

FCA in the UK,

CySEC in Cyprus,

MFSA in Malta,

BaFin in Germany,

Finma in Switzerland, Finansinspektionen in

Sweden and

Finland, Finanstilsynet in

Norway and

Denmark,

FSA in Seychelles,

FSCA om South Africa,

DFSA in Dubai,

SFC in Hong Kong,

FSA in Japan,

NFA in U.S,

ASIC in Australia or

FSP in New Zealand. It all depends on where you live in the world! More trusted licensed bodies gives higher broker ratings, while less trusted jurisdictions such as FSC in BVI and IFSC in Belize are two of the licensing frameworks that will not even be included in our top lists. Their regulatory frameworks are simply too weak and don't give enough protection for customers. We make sure to confirm all licensing numbers mentioned in our online trading broker reviews.

Which Payment Solutions Exist?

Short Selling's team will review all payment solutions for deposits and withdraws. Being able to safely and quickly get started is crucial for many new short selling clients. Some of the preferred methods include but are not limited to Bank transfer, BACS, VISA, Mastercard, Maestro, Klarna, Neteller, Skrill, PaySafe, PayPal, Rapid Transfer, Sofort, Trustly, Venus Point and Zimpler. Getting started quickly with a new short selling broker with CFD's can be crucial for many players and a wide range of options will give higher ratings, while few options will give a lower rating.

How Quick is it to Open an Account?

Opening a short selling account should be as simple as ordering UberEat and even easier than checking into a flight. We carefully evaluate the process top open an account for short selling with CFD's and are testing all relevant sites in-house. It's crucial to be able to open up a trading account both easily and fast. It should be equally simply regardless of your location and sites with a smooth process gets high ratings, while troublesome account openings loose points.

What about the instruments?

Investors and speculators often enjoy having a great variety of instruments. However, being able to go short in the right shares are also crucial. Therefore, ShortSelling.com consider both larger companies, more unusual ones and especially shares with decent volume so it's easier to make accurate decisions. Short selling broker sites with a decent variety and a good number of alternatives get higher ratings, while a limited amount of shorting opportunities get lower rating.

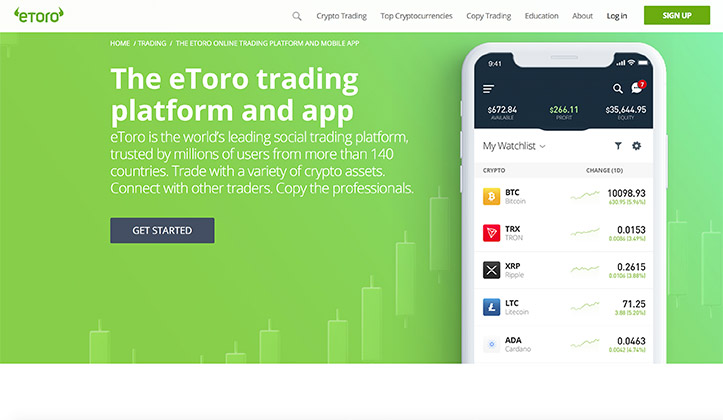

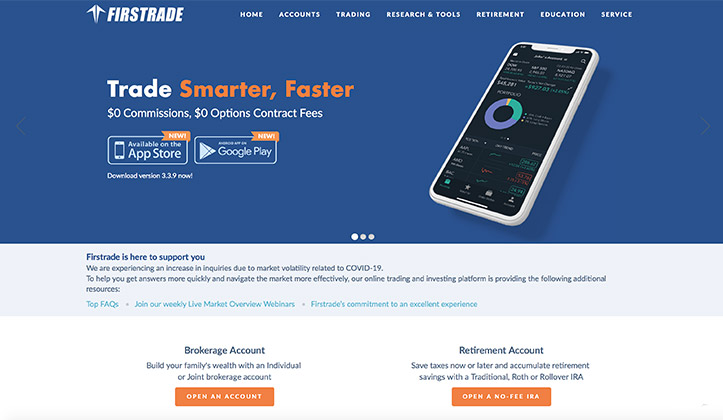

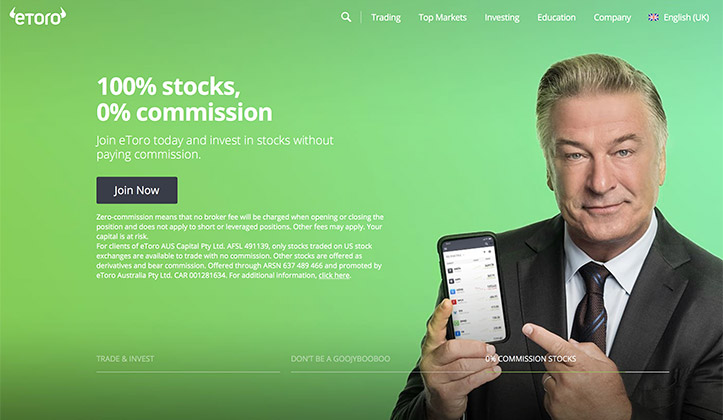

How stable and advanced is their web platform?

A traders platform is crucial since that's where all the action takes place. We describe each CFD-platform for the short selling brokerage firms and will explain if they are built as any form of white label or if they are proprietary. ShortSelling.com evaluate all kinds of functions. Some examples include search functionality, ability to change between various platforms, the look and feel of graphs, how frequent news feeds are available for free and all the technical analysis tools offered. By sharing a screenshots, you will better understand how it is to trade with a certain broker. You should be able to explore short selling platforms without the need to sign up immediately, or by testing in demo-mode first. Sites that makes it simple for potential traders while having a stable, advanced and flexible platform gets higher ratings while white labels and less advanced versions get lower ratings.

Can you Easily Go Short from The Mobile Platform?

Having the ability to selling shares you don't own thanks to CFD's from a mobile platform can be worth its weight in gold. We review every single shorting broker's mobile platform since that's where an increasing amount of people will be doing at least a couple of trades. We provide screenshots to give you a better understanding of how it looks like from a mobile device based on iOS or Android.

How are Costs and Fees Displayed?

How much will it cost you in case you don't use the site in 6 or 12 months? Do your new casino add on any fees for deposits or withdrawals? Each brand will be reviewed in-depth to cover and showcase what you can expect in terms of annoying costs and fees.

What Can be Said About Their Customer Support?

Hopefully, your short selling CFD broker will not have issues at all. But realistically, users may need to contact the customer service at some point. In order to get top ratings, the brokerage firm should be open during all trading hours, either by live chat, telephone or email. Obviously, they should also be able to give a fast and relevant reply on your query. We always test the brokers replies with a few random questions to check their knowledge, answering speed and aim to assist whatever it takes.

What are rating scores based upon?

Category (percentage)

Costs and fees 10%

Customer support 10%

Instruments variety 10%

Payments: Speed & Selection 10%

Web platform 10%

Mobile platform 10%

Speed of account opening 10%

Licence, reputation, and security 10%

VIP and retention program 10%

Regulation 10%.

If you got any questions, please don't hesitate

to contact us.

Top 15 Best Brokers

Top 15 Best Brokers